Author: Josef Cutajar and Justin Mizzi

Over recent years, there has been increased attention among local investors on the state of the Maltese real estate market. This heightened focus mainly centred on the following aspects: (i) planning concerns, particularly relating to overdevelopment and the quality and sustainability of our product; (ii) questions about oversupply, primarily in the office and hospitality sector; and(iii) housing affordability issues.

It is no secret that real estate inherently lies at the heart of virtually every local investor, either directly through the ownership of property for commercialisation, leasing, and/or development and sale purposes, or indirectly via financial instruments connected with the real estate sector. In this respect, although it is relatively common practice for financial commentators and journalists to regularly report on the trends, statistics, and performance of the Maltese real estate market, on the other hand, there seems to be some disregard on how the sector features across the local capital market.

In our view, it is important to provide a perspective on how central the real estate sector across the Maltese capital market is. Most of the 32 companies listed on the Regulated Main Market (Official List) of the Malta Stock Exchange (“MSE”) are in some way or another exposed to the local real estate market including the core domestic banks (namely, APS Bank p.l.c., Bank of Valletta p.l.c., HSBC Bank Malta p.l.c., and Lombard Bank Malta p.l.c.) which are hugely exposed to the real estate market through mortgages and commercial property loans.

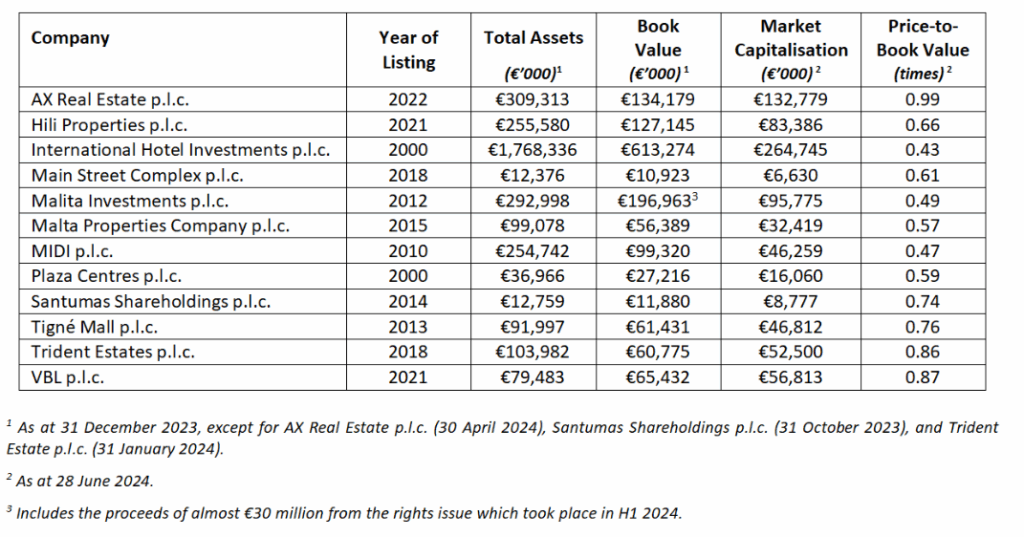

Out of these 32 companies, however, twelve can be categorised as directly related to the real estate sector. Of these, six companies also have bonds listed on the Regulated Main Market (Official List) of the MSE. These comprise AX Real Estate p.l.c., Hili Properties p.l.c., Malta Properties Company p.l.c., MIDI p.l.c., Plaza Centres p.l.c., and International Hotel Investments p.l.c. (“IHI”) – the company behind the Corinthia brand.

Although IHI is principally involved in the hospitality segment, in practice it can be viewed as a real estate company when considering its sizeable asset base principally made up of hotel and commercial properties situated in Malta and internationally. Furthermore, in contrast to hotel operators, the pricing and valuation of hotel property companies like IHI is usually tested against metrics, standards, and methods that are typically applied within the real estate space.

Looking at the numbers

In aggregate, the property-related equity issuers have a market capitalisation of circa €840 million and represent around 18% of the total market capitalisation of €4.81 billion of the local equity market. However, nearly a third of the market capitalisation of these twelve equity issuers appertain to IHI which has a market capitalisation of approximately €265 million.

AX Real Estate p.l.c. comes next with a market capitalisation of €132.78 million whilst the remaining ten property-related companies all have a market capitalisation of less than €100 million. These range from the mid-sized Malita Investments p.l.c. and Hili Properties (a subsidiary of Hili Ventures Limited), which have a market capitalisation of circa €96 million and €83 million respectively, to the smaller-sized companies such as VBL p.l.c. (€57 million), Tigné Mall p.l.c. (€47 million), and Main Street Complex p.l.c. (€7 million).

All twelve listed property-related companies operate in the commercial real estate segment except for MIDI p.l.c. which activity is mostly related to the development and sale of real estate situated at Tigné Point and Manoel Island. Moreover, only IHI and Hili Properties have an exposure to real estate overseas, with Hili Properties also having an interesting mix of properties including office space, McDonald’s restaurants, shopping centres, a hospital, and industrial property.

Table 1: Real estate companies listed on the MSE

Challenging times for the equity market

Unfortunately, the fortunes of the Maltese equity market waned considerably in recent years, and this is reflected by the marked contraction in the volumes of trading as well as the broad downturn in share prices. This situation is currently at the top of the MSE’s agenda which, together with various market players and stakeholders, are currently examining six strategic initiatives with a view of improving market liquidity and investor experience.

These plans aim at reducing trading costs, enhance company relations and investor research, and promote market activity through share buybacks, executive share compensation, and the introduction of ‘Liquidity Providers’.

Despite the continuous buoyant performance of the real estate market in general, nearly all share prices of the local property-related equity issuers are at a steep discount to their respective book values per share. In fact, the average price-to-book value of the nine property-related issuers which were listed on the MSE as at the end of 2019 stood at 1.08 times. In contrast, this was at 0.67 times as at the end of June 2024 for the twelve property-related listed companies which essentially means that the market is giving a one-third haircut to the valuation of these companies.

Although the downbeat sentiment across local shares might be more linked to the market per se rather than specifically attributable to the companies, there are still various avenues that companies might consider with a view of creating shareholder value.

One of these could be the possibility of consolidation through merger and acquisition (“M&A”), especially among the companies that own just a single building, as this type of activity is often regarded as one of the main drivers for any company to consider an equity listing apart from other benefits such as those related to corporate governance and transparency as well as increased visibility and prestige.

A case in point is the acquisition by Hili Ventures Limited of more than 33% of the share capital of Tigné Mall p.l.c. that took place over the past eight months which was indeed a rare moment of quasi-M&A activity across the local capital market.

Looking at the bond market

Meanwhile, the situation in terms of investor sentiment and participation is surely more upbeat when it comes to the local corporate bond market. Apart from the six companies that are both equity and bond issuers, there are circa 30 other bond issuers (out of a total of 71 companies) which are heavily involved in the real estate sector.

Within this pool, the diversification aspect is also a bit wider compared to the equity market, as apart from the accommodation, lease, and development companies, there are other companies which, for instance, are involved in the supply of building and finishing materials.

Furthermore, in terms of the amount of total bond issuance, the real estate sector in its broadest perspective account for circa 55% (or €1.45 billion) of the local corporate bond

market (€2.62 billion) which is indeed significant. As at the end of 2019, the size of the local corporate bond market stood at €1.82 billion, of which €1.01 billion (or circa 55%) comprised issuers closely related to the real estate sector.

A call for a new era

Without doubt, the real estate sector has been essential for the growth of the Maltese economy across the years, and part of this success has naturally been also due to the local capital market as it did not only serve as a platform for fund raising and investment, but also as an important source of information for market participants.

Despite this track record, it is widely recognised today that the next evolution that the country needs to embark on is the notion of quality and sustainability both from an economic viewpoint as well as in terms environmental consciousness.

In this respect, the interplay between the real estate sector and the capital market ought to be leveraged further with a view of mobilising the necessary resources for Malta to improve its attractiveness and competitiveness which are so essential for further economic development and success.

Disclaimer:

This article was written by Josef Cutajar, Financial Analyst at M.Z. Investment Services Limited (“MZI”), and Justin Mizzi, Real Estate Valuer at Archi+ Limited (“Archi+”). The authors have obtained the information contained in this article from sources believed to be reliable and have not verified independently the information contained herein. The contents of the article are the authors’ views and may not reflect the other opinions of the organisations. The article is being published solely for information purposes and should not be construed as investment, legal, or tax advice, or as a recommendation to buy, sell, or hold any security, investment strategy or market sector. Any financial instruments referred to in this article may not be suitable or appropriate for every investor. Prospective investors are urged to consult their Investment Adviser prior to making an investment. Past performance is no guarantee of future results, and the value of investments may go down as well as up. MZI and Archi+ accept no responsibility or liability whatsoever for any expense, loss or damages arising out of, or in any way connected with, the use of all or any part of this article. No part of this article may be shared, reproduced, or distributed at any time without the prior consent of MZI and Archi+.

M.Z. Investment Services Limited of 63, MZ House, St Rita Street, Rabat RBT 1523, Malta, is regulated by the Malta Financial Services Authority and licensed to conduct investment services business in terms of the Investment Services Act (Cap. 370 of the Laws of Malta). MZI is a member of the Malta Stock Exchange and is an enrolled Tied Insurance Intermediary under the Insurance Distribution Act (Cap. 487 of the Laws of Malta) for MAPFRE MSV Life p.l.c. Telephone: +356 21453739; Email: info@mzinvestments.com; Website: www.mzinvestments.com