8 October, 2025

Author: Josef Cutajar

On 4 October 2025, SD Finance plc announced the publication of a Base Prospectus and Final Terms following regulatory approval for the admissibility to listing on the Regulated Main Market (Official List) of the Malta Stock Exchange of €33 million 5.20 per cent unsecured bonds redeemable in 2031. The offer is primarily targeted at holders of the existing 4.35 per cent €65 million unsecured bonds maturing on 25 April 2027 as at 30 September 2025, who will be treated as preferred applicants.

The offer period will run from Tuesday 7 October 2025 until Friday 24 October 2025, although it may close earlier in the event of over-subscription. Any balance not taken up by preferred applicants will be available for subscription by Authorised Financial Intermediaries listed in Annex II of the Final Terms through an Intermediaries’ Offer. Net proceeds from the issue will be advanced to SD Holdings Limited, the guarantor of the bonds, in order to cover inter-company loans originally granted to subsidiaries of the Group for the acquisition of the Xemxija Bay Hotel (€7 million) and the development of the St George’s Bay Project (€20 million). A further €5.40 million will be deployed by SD Holdings Limited for general corporate funding purposes.

SD Holdings Limited is the parent and holding company of the db Group, a family-owned business that traces its origins back to 1984. Over four decades the Group has expanded rapidly, evolving into one of the largest and most diversified operators in Malta’s hospitality, catering, leisure, and entertainment sectors. More recently, its footprint has extended into real estate development, reflecting the Group’s ability to adapt to evolving market dynamics whilst capitalising on growth opportunities.

The Group’s hospitality arm currently includes two of Malta’s largest hotels – the four-star all-inclusive 541-room db Seabank Resort & Spa in Mellieħa Bay, and the 515-room db San Antonio Hotel & Spa in Qawra – together with The Melior Boutique Hotel in Valletta. In late 2024, the Group also completed the acquisition of the former Porto Azzurro Hotel in Xemxija, now rebranded as Xemxija Bay Hotel, which adds further diversification to its accommodation offering.

The hospitality segment is complemented by Lifestyle Group, which encapsulates db Group’s extensive restaurant operations. The portfolio spans a wide range of brands aimed at three distinctive markets: refined dining, day-life concepts, and casual dining. Alongside its outlets, the Group has established strategic alliances with global giants such as Hard Rock Café International and Starbucks Corporation. In recent years, this line-up has been broadened further with the acquisition of new franchises including EL&N London and Italian gelateria brand GROM, consolidating db Group’s position as a leading player in Malta’s food and beverage (“F&B”) sector.

Having achieved considerable success domestically, db Group took the strategic step in 2022 to expand its operations internationally. A dedicated office was opened in Mayfair, London, with the first major project being the acquisition of a 35-year lease on a historic listed building in Cavendish Square, Marylebone, in the heart of London’s West End. Following a GBP12 million investment in restoration and redevelopment, the site was inaugurated on 30 September 2025 as Aki London – a sophisticated lounge, bar, and restaurant offering an exclusive haute Japanese dining experience. The project not only marks db Group’s entry into one of the most competitive hospitality markets globally but also showcases the Group’s capability to execute high-profile projects overseas.

Building on this momentum, the London office was also instrumental in securing a landmark joint venture with RAK Hospitality Holding LLC, an entity owned by the Government of Ras Al Khaimah in the United Arab Emirates (“UAE”). The joint venture company, HR Hotel FZ-LLC, will oversee the development of a mixed-use project on a prime beachfront site within Ras Al Khaimah’s Beach District, in proximity to Al Marjan Island. The project will introduce the first Hard Rock Hotel & Residences in the UAE, comprising a five-star hotel with approximately 304 rooms and around 395 branded residences. Facilities will include a rooftop bar, signature beachfront dining venues, extensive event and conference space, a beach club, pools, spa, and fitness centre. The development is expected to be completed in 2028, at which point db Group will also be entrusted with the operation of the Hard Rock Hotel & Residences Ras Al Khaimah.

Closer to home, db Group is nearing completion of the db St George’s Bay Project, a transformative mixed-use development representing a total investment of close to €260 million. Scheduled for inauguration in 2026, the project will introduce Malta’s first Hard Rock Hotel, alongside two luxury residential towers known as ORA Residences. These will be complemented by St George’s Mall, a retail complex spanning over 20,000 sqm and hosting international brands, together with extensive underground parking, a supermarket, and a wide range of lifestyle amenities. The development will also feature 5,000 sqm of open spaces, landscaped gardens, and a large entertainment area, positioning it as a new landmark destination in Malta.

The Hard Rock Hotel St George’s Bay is set to open in the second quarter of 2026, introducing a new dimension to the local tourism product. Designed to integrate Malta’s architectural heritage with the brand’s global hospitality standards, the hotel will offer 394 rooms, including 25 suites with private pools, alongside 15 restaurants, lounges, and bars. The property will also feature a rooftop pool, a branded beach club, and one of Malta’s largest wellness centres spanning 3,000 sqm. Within the project, the ORA Residences will comprise 179 premium apartments across the twin towers, with nearly all units already under promise of sale agreements as the eight penthouse sky villas have not yet been placed on the market. Residents will benefit from a suite of exclusive services, including concierge assistance, chauffeur-driven cars, and access to private pools and wine cellars, reflecting the project’s emphasis on luxury living.

From a financial perspective, db Group has demonstrated strong and consistent growth since its first corporate bond issue in 2017. Between March 2017 and March 2025, Group revenues and EBITDA roughly doubled, whilst the asset base expanded at a compound annual growth rate of 13.32 per cent to reach €591.84 million at the end of FY2025 compared to €217.60 million in FY2017. Although total debt, including lease liabilities, rose to almost €200 million by March 2025, the Group’s net gearing declined substantially to 30.68 per cent from nearly 48 per cent in FY2017, highlighting prudent financial management.

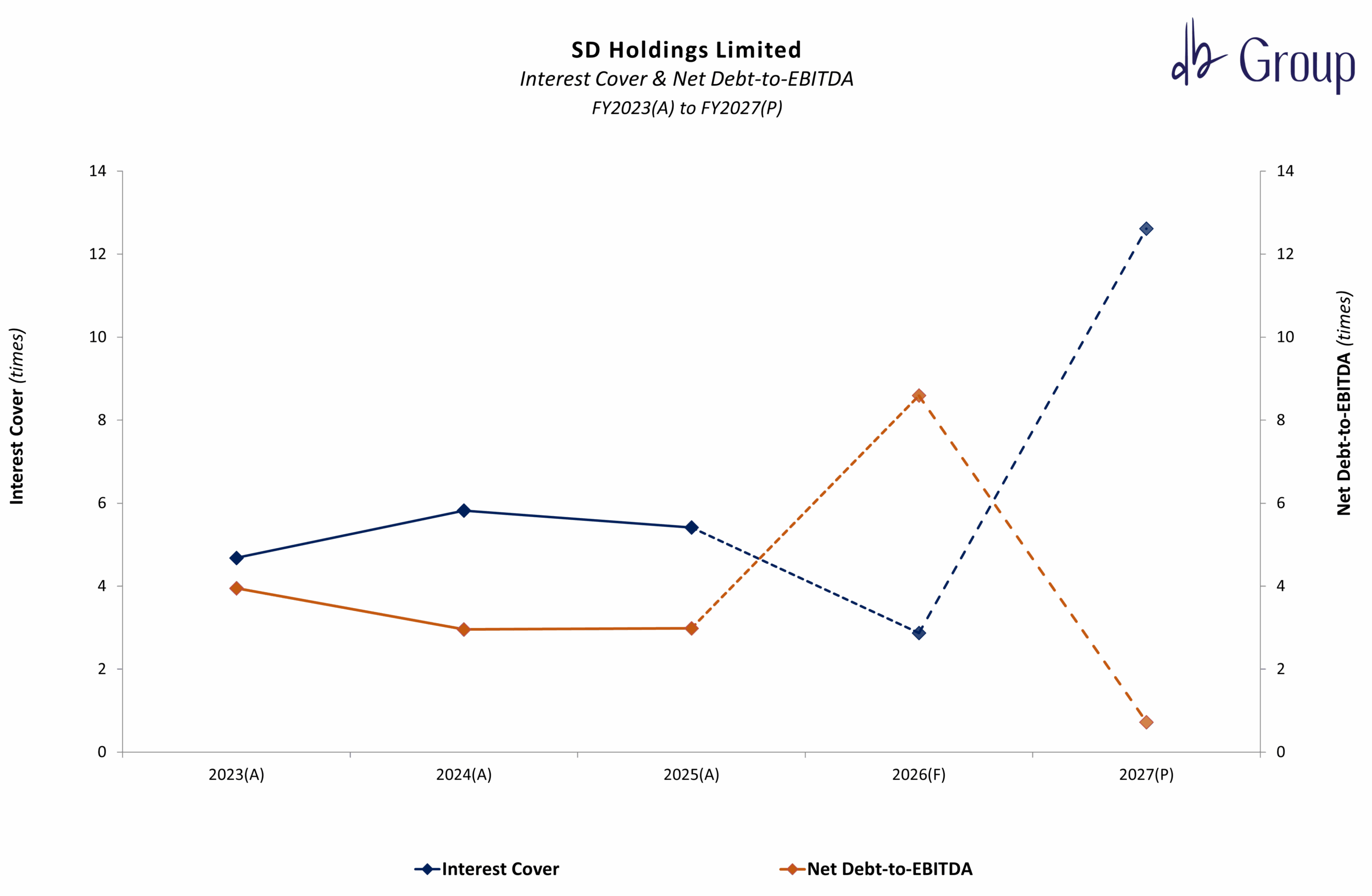

Looking ahead, db Group expects significant growth, particularly in FY2027, which will mark the first full year of operations of the St George’s Bay Project. Group revenues are forecast to approach €378 million, fuelled by contributions from Aki London, the Hard Rock Hotel St George’s Bay, and the recognition of revenue from the sale of ORA Residences. EBITDA is projected to climb to almost €181 million, driven largely by the real estate component of the St George’s Bay Project (almost €125 million) but also supported by €22 million from the new Hard Rock Hotel and adjacent F&B outlets, and a steady contribution of around €35 million from the Group’s existing businesses.

Financial discipline is expected to remain at the heart of the Group’s strategy. By FY2027, net gearing is estimated to drop to just above 25 per cent, whilst the debt-to-assets ratio is projected at 0.40 times. Coupled with the projected cash balance of €192.13 million, the Group will retain substantial financial flexibility and liquidity to pursue further large-scale investments beyond the RAK Project.

The new bond issue represents a further step in db Group’s long-term growth strategy, underscoring its commitment to the Maltese capital market and to the investors who have supported its journey since 2017. It offers investors exposure not only to a household name in Malta’s hospitality sector but also to an organisation whose diversification, international expansion, and capital discipline underpin its ability to deliver sustained long-term growth.

This article was written by Josef Cutajar, Financial Analyst at M.Z. Investment Services Limited (“MZI”). The author has obtained the information contained in this article from sources believed to be reliable and has not verified independently the information contained herein. The views expressed are those of the author and may not reflect the views of MZI.

The article is intended solely for information purposes and does not constitute investment advice, a personal recommendation, or an offer or solicitation to buy or sell any financial instrument. Investments in bonds involve risk, including the potential loss of capital and may not be suitable for all investors. Past performance is not indicative of future results. Prospective investors should seek financial advice and consider all information contained in the Base Prospectus and Final Terms before making an investment decision.

MZI is acting as Sponsor to SD Finance plc and an authorised financial intermediary to the SD Finance plc bond issue.

M.Z. Investment Services Limited of 63, MZ House, St Rita Street, Rabat RBT 1523, Malta, is regulated by the Malta Financial Services Authority and licensed to conduct investment services business in terms of the Investment Services Act (Cap. 370 of the Laws of Malta).